who do i call about a state tax levy

Visit the IRS website or contact a local office in California. All amounts up to the total amount due to.

Things To Do If The Irs Threatens To Levy Your Bank Account Robergtaxsolutions Com

Tax levies are collection methods used by the IRS where they can legally seize your assets to cover back taxes.

. For the status of your state tax. An IRS tax levy is a legal seizure of your property to compensate for your tax. A tax levy is not the.

Customer service phone numbers. Liens are filed with the county Register of Deeds andor the Secretary of State as security that a debt will be paid from proceeds when a taxpayer sells real or personal property. For more information you may call the IRS at 800 829.

It can garnish wages take money in your bank or other financial account seize and sell your. A state tax levy is a collection method that tax authorities use. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

A tax levy itself is a legal means of seizing taxpayer assets in lieu of previous taxes owed. The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most. When applicable you will receive a notice from the IRS containing your rights of appeal in the event your state tax refund is levied.

Through a tax levy you may have money taken from your bank. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as. A levy against currently held contract payments and future payments to an individual or entity that has assessments andor tax liens due to the SCDOR.

How do I contact the IRS about a levy. Federal Income and Payroll Tax. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for.

A property tax levy is the right to seize an asset as a substitute for. Resolving your federal tax liabilities with your citymunicipal tax refund through the. A tax levy is a legal seizure of your property by the IRS or state taxation authorities.

Who do i call about a state tax levy Sunday July 3 2022 Edit. A tax levy is a process that the IRS and local governments use to collect the tax money that theyre owed. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance.

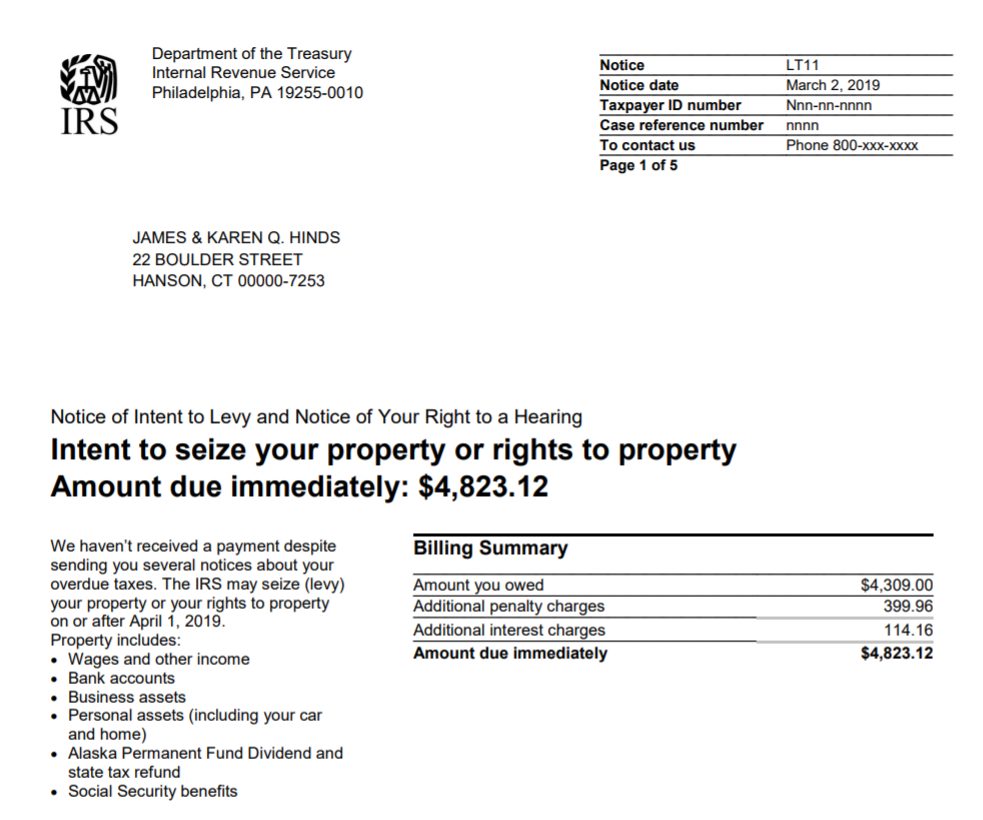

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the IRS right away.

Irs And State Bank Levy Information Larson Tax Relief

Irs Tax Debt Relief Help Resolve Irs Tax Levy Problems Victory Tax Solutions

State Bank Levy How To Where To Get Help With Bank Levies

Who Do I Call About An Irs Tax Levy

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

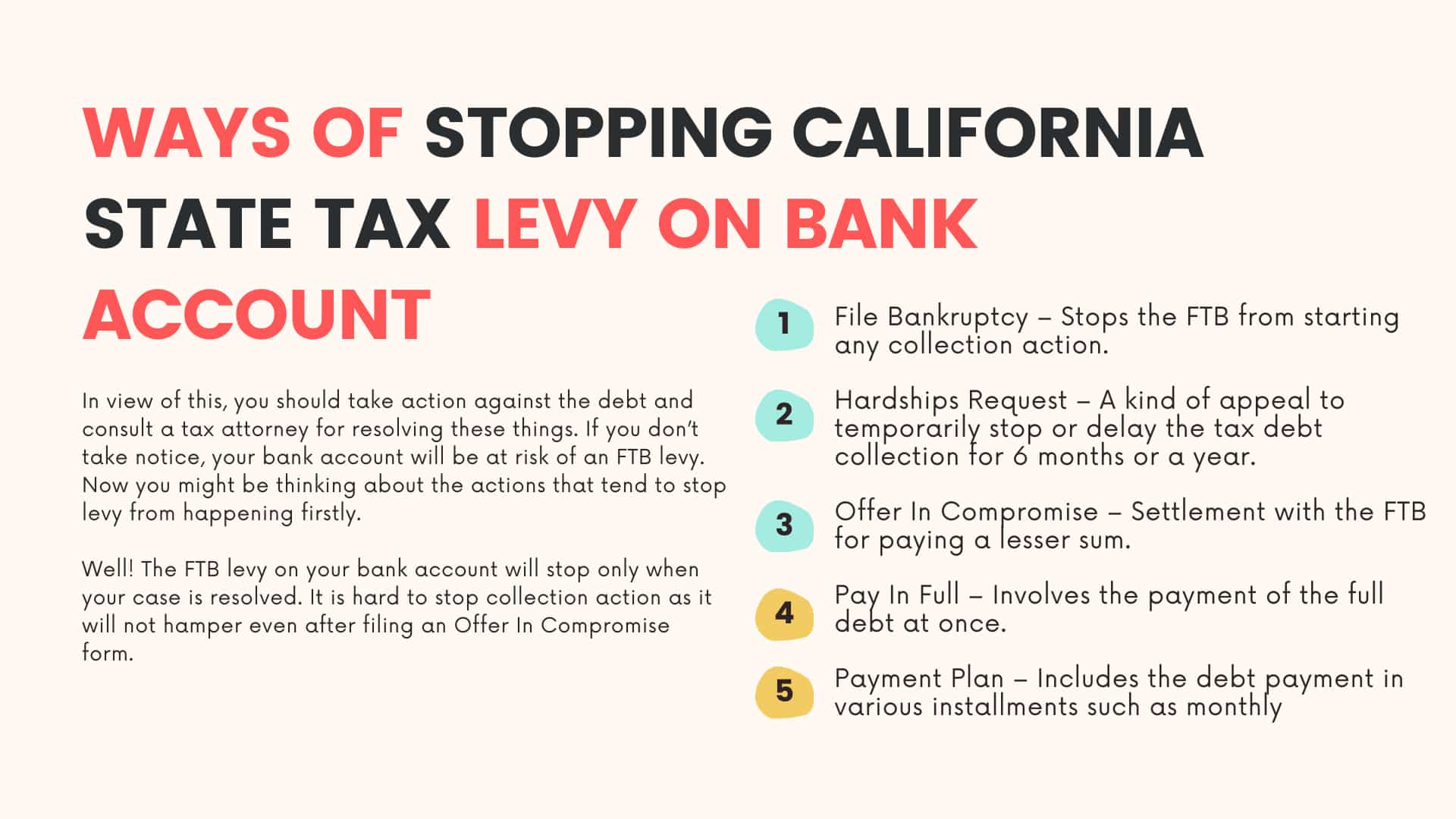

3 Proven Ways To Stop California State Tax Levy On Bank Account

3 Things You Should Know About A New York State Levy If You Owe Back Taxes Tenenbaum Law P C

Idaho State Tax Commission Tax Scam Alert Watch Out For Two New Tax Scams That Come In The Mail Several Businesses Recently Received A Notice That Threatens To Seize And Levy

New York State Tax Officials Warn Of New Scam Wrgb

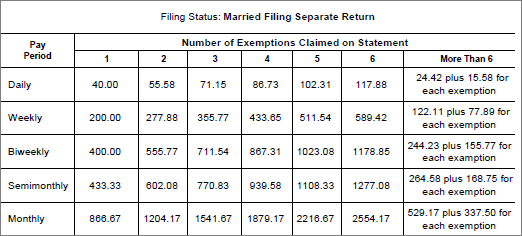

Setting Up Federal And State Tax Levies

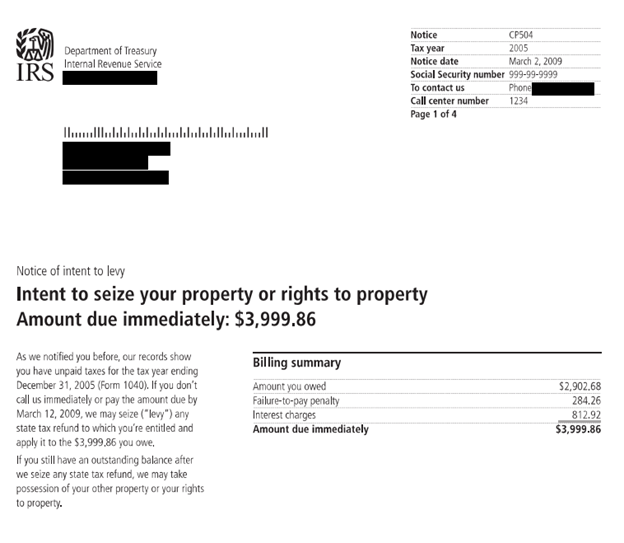

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Form 12153 Request For A Collection Due Process Or Equivalent Hearing

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Does Your State Levy A Capital Stock Tax Tax Foundation

Irs Levy Tax Matters Solutions Llc

3 Proven Ways To Stop California State Tax Levy On Bank Account